SENIOR-QUALITY PORTFOLIO, LEADING GROWTH POTENTIAL

- Senior-quality precious metal portfolio

- 20 producing assets(i) anchored by a 5% NSR royalty on Agnico Eagle’s Canadian Malartic Complex(ii)

- Peer-leading organic growth profile

- Attributable GEO delivery growth of ~40% based on Osisko’s current 5-year outlook (2028e)

- Highest concentration of assets in low-risk Tier-1 mining jurisdictions(iii)

- Current production and development project pipeline

- Strong balance sheet & disciplined capital allocation strategy

- +C$725 million in available liquidity as of Sept 30, 2024 – between cash and undrawn revolving credit facility (incl. C$200 million accordion)

+185royalties, streams and offtakes |

US$3.9Bmarket cap |

77-83k2024 GEO Delivery Guidance |

97%margin business |

1.04%dividend yield |

1.27xConsensus P/NAV |

Notes:

(i) Includes G Mining Ventures Corp.’s Tocantinzinho (TZ) mine, and Agnico Eagle Mines Ltd.’s Akasaba West satellite mine at Goldex

(ii) Canadian Malartic Open Pits 5.0% NSR Royalty; Canadian Malartic Odyssey Underground Blended 4.61% NSR Royalty

(iii) vs. precious metals royalty & streaming peers; ‘Tier-1’ mining jurisdictions defined as: Canada, USA, Australia

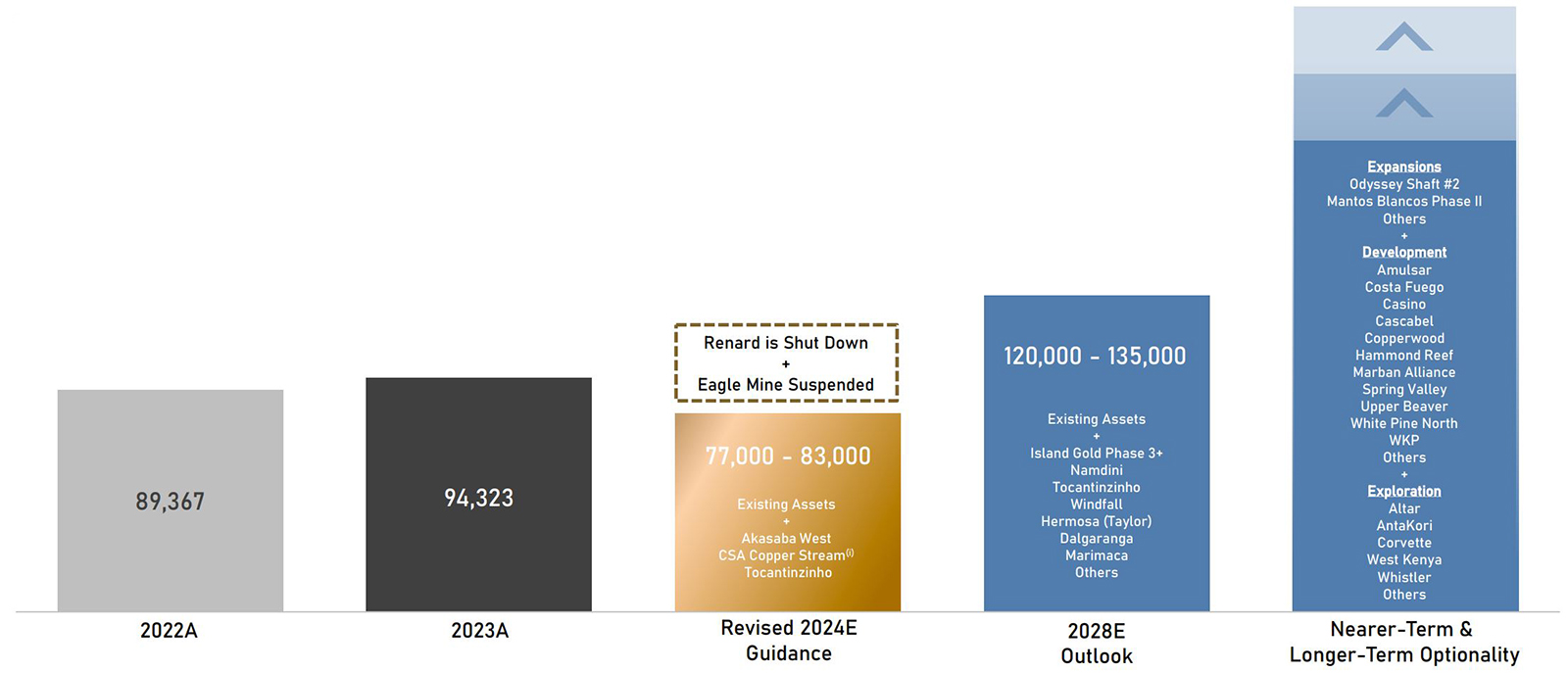

Entering an Important Phase of Growth

GEOs (gold equivalent ounces)

Notes:

- This 2024 outlook replaces the previous outlook (published on February 20, 2024); the 5-Year Outlook is unchanged.

- This outlook (published on February 20, 2024) is based on publicly available forecasts from our operating partners. When publicly available forecasts on properties are not available, Osisko obtains internal forecasts from the producers or uses management’s best estimate.

- The 2024 guidance uses current 2024 consensus commodity prices and a gold/silver price ratio of 83:1. The 5-year outlook uses current long-term consensus commodity prices and a gold/silver price ratio of 76:1.

- Optionality bar is illustrative only:

- “Development” defined as partner having at least completed a Preliminary Economic Assessment (or more) on the project;

- “Exploration” defined as partner having completed a Mineral Resource Estimate (MRE) on the project or is in the process of exploratory drilling in or to be working towards an initial MRE.

Source:

(i) The commencement of deliveries from the CSA Copper Stream started on June 15th, 2024 (economic effective date); first physical deliveries were received on July 7th, 2024.